Basic Understanding About Income Tax In Malaysia

Key Points

- Income tax is a system of taxation imposed on individuals or entities (corporations) by governments

- Understanding income tax is as important as learning other financial knowledge.

- Tax relief allows you to reduce your chargeable income, resulting in paying lesser tax.

Many of us find preparing and filing our income taxes in Malaysia a challenging experience every year. The process can be anxiety-inducing, especially for those who are not used to it!

You should be aware of certain obligations that come with earning your own salary as a Malaysian worker. It is your duty to pay taxes that come with the salary you receive, which is known as income tax (cukai pendapatan).

However, do not panic if you are new to this working society, as it is your employer’s duty to remit your income taxes to the Lembaga Hasil Dalam Negeri Malaysia (LHDN) or Inland Revenue Board (IRB). Although it is the responsibility of your employer to pay for your income tax, as an employee, your responsibility is filing your income tax returns.

Before we start, what is income tax and should you pay it?

What Is Income Tax?

Income tax is a system of taxation imposed on individuals or entities (corporations) by governments. The income tax system is used to finance government activities and services. In most countries, it is the main source of revenue for the government. Taxation rates are different between countries.

Income tax in Malaysia is a progressive tax, which means that the amount of tax paid increases as income increases. There are also special rates for certain types of income such as dividends and capital gains. Income taxes in Malaysia are designed to be “territorial,” which means an individual or entity is taxed only on incomes earned within the country ONLY.

Who Should File Income Tax?

According to LHDN, Malaysian employees are required to pay taxes if they earn an annual income of at least RM34,000 (after EPF* deduction).

* EPF, or the Employees’ Provident Fund is a savings and retirement plan for employees working in Malaysia. This has been set up to help ensure that employees can afford their future needs when they retire.

The flat rate of 30% taxes from the total taxable income is required for non-resident individuals. Non-residents whose salary is not less than RM25,000 and in higher positions will be taxed at a flat rate of 15% for five consecutive years. However, it will only allow up to five non resident employees in each qualified company under Pelan Jana Semula Ekonomi Negara (PENJANA) initiative.

What Are Tax Reliefs?

The effects of tax reliefs can be profound. They allow you to reduce your chargeable income, which in turn affects what rate of taxes will apply and thus the amount that needs paying.

Tax relief is any government program or policy designed to help individuals and businesses reduce their tax burdens. There are income exemptions from tax including medical and educational expenses as well as childcare costs.

The government has introduced a range of new tax reliefs for mental health costs, including consultations with psychiatrists and psychologists. They have also listed the purchase of COVID-19 test kits as qualified which is great news!

The government is offering a variety of incentives to encourage people who work in the tourism industry. From tax relief for your contributions, up to RM4000 per year if you’re self-employed! For more information, you may check the LHDN website.

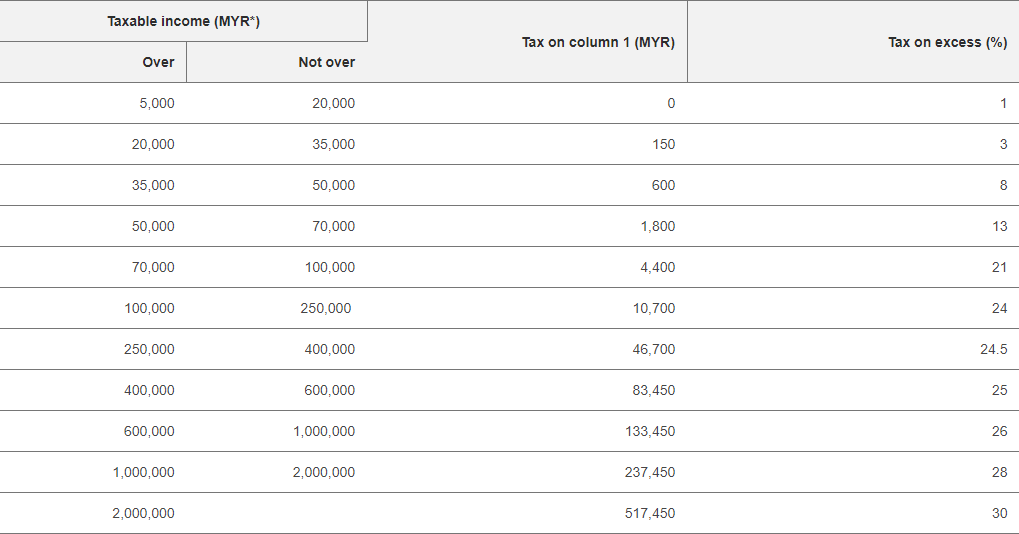

Personal Income Tax Rate

(Source: PWC)

*In Ringgit Malaysia

How Do File Income Tax?

Below are steps on how to file income tax.

- Register and create an account on e-Daftar website to get a tax reference number.

- Prepare required documents for identity verification.

- You can choose to visit the LHDN office OR official website to receive your pin.

- Login to myTax website and fill in all necessary information and file your taxes on the website.

- Make sure all information is correct before submitting.

If you paid more than you are supposed to, you are then entitled to a tax refund. Once you submit the e-forms, your refund will be credited to the bank account you provided within 30 working days.

When Should You File Income Tax?

The deadline for filing your taxes online of an employed individual normally is April 30 yearly. Although there is a 15-days grace period, you are encouraged to file your income tax on time to avoid penalties. Do check ahead if the government has announced an extension.

Conclusion

There is no better time than now to find out how you can file your taxes in Malaysia for the Year of Assessment 2022. With our easy and straightforward guide, it will be like a breeze! The accounting and human resources departments are always happy to help with any questions you may have about taxes.

If you’re looking for a way to increase your financial knowledge, then learning how to calculate income tax is just as important! Not understanding what goes into calculating the amount of taxes that are due can lead us down an unproductive path.