What are the Benefits of Having a Good Credit Score?

Key Points

- The chances for your loan or credit card approval are pretty high.

- The approval process is quite fast.

- You can have better negotiating power.

- Reduce the interest rate.

- You may be able to obtain increased credit limits.

You’re probably wondering what a credit score is. Allow me to explain. A credit score is a digit number, typically ranging from 300 (poor) to 850 (excellent), representing your creditworthiness and predicting your ability to repay debt. Simply put, your credit score is a reflection of your financial health.

The bank wants to look at your credit score because it will help them understand the risks they may face if they decide to lend you money. It will also tell them how likely you are to pay your bills on time and the money you borrowed. Not only that, but it also assists banks in evaluating your credit or loan application.

However, the number of your credit score can influence whether the bank approves or rejects your application. In other words, the lower your credit score, the more likely your loan will be denied. Meanwhile, the higher your credit score, the more likely banks approve your applications.

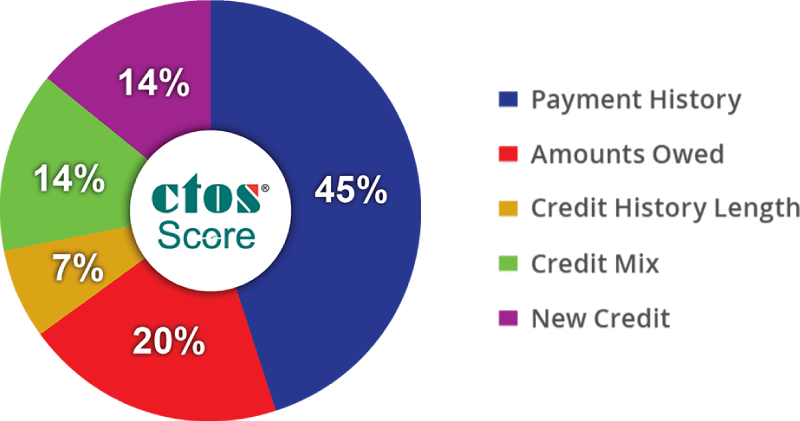

The credit score will be calculated based on the information gathered from the Central Credit Reference Information System (CCRIS) and CTOS (Credit Reporting Agency):

- Payment behavior (45%) – Based on your payment history.

- Amount owed (20%) – Based on your outstanding amounts owed.

- Credit history (7%) – Based on the length of your credit history.

- Credit mix (14%) – Based on the variety of credit accounts you have made up.

- New loans (14%) – Based on new credit (opened new credit accounts)

That is why having a good credit score is essential. It can quickly help the bank trust and approve your application, say if you want to apply for any loan or credit card in the future. As a result, I will share the benefits of a credit score that you can enjoy if your credit score is in the healthy stage!

1. The chances for your loan or credit card approval are pretty high

Credit scores are classified into two types: good and bad. Assume you have a good credit score, and the bank quickly approves your loan or credit card. This demonstrates that you are responsible and committed to paying your bills. As a result, banks and lenders are more likely to approve your credit applications.

However, if you have a low credit score, it indicates that you are a risky borrower, and your loan or credit card application may be delayed or even rejected. Because some banks that act as lenders may be unwilling to take the risk.

2. The approval process is quite fast

Nobody wanted to wait long for their application to be approved, right? However, your loan or credit card application depends on your credit score. The higher your credit score, the faster banks will decide to lend you money because they know your credit score is good. You are a responsible person committed to repaying your debt without fail.

However, if your score is average or low, your application may need to go through several channels before it is approved, which will take longer or may be rejected by the bank.

3. You can have better negotiating power

A good or excellent credit score includes negotiating a lower interest rate or a better repayment plan with the bank when applying for a new loan or credit card. Isn’t it great?

Why do you have that negotiating power? Because the bank that will approve your application can see from your credit history that you are responsible and capable of repaying them promptly and consistently. As a result, maintaining an excellent credit score can provide you with this benefit.

4. Reduce the interest rate

When we talk about interest rates, we obviously want to find low and affordable rates for you to repay to the bank, right? This is why your credit score is used to calculate your interest rate. You will benefit from a low-interest rate with a good credit score. More Malaysian banks are now designing tiered interest rates based on credit scores. If you have a good credit score, consider yourself fortunate.

5. You may be able to obtain increased credit limits

Who doesn’t want to have higher credit limits? I do! Before the bank approves your application, they will check your income and credit score. This will determine how much money you can borrow based on your earnings. Assume you have a healthy credit score, and the bank is willing to trust you by increasing your credit limit.

This is because they can assess your ability to pay your bills on time and may be willing to lend you more money. It will help if you want to apply for a loan or credit card that requires a one-time or permanent credit limit increase.

If your credit score is currently low, one way to improve it is to pay your debts on time and without delay. More information can be found here.

Verdict

You must have a good or excellent credit score because it will help you apply for future loans or credit cards. A good credit score can make both parties’ lives easier. Your application will be approved quickly, and you can use the loan for whatever purpose you desire, such as one day buying a house.

Remember that having a good credit score is not easy because you must be committed to your own things. However, you must exercise self-control and ensure you pay off all your debts on time to maintain your credit score.

Related: Differences between Conventional and Islamic Credit Card