Drive+ Membership: More Savings, More Benefits!

Get 6 exclusive benefits, including up to 80% OFF on road tax, for just RM39.90!

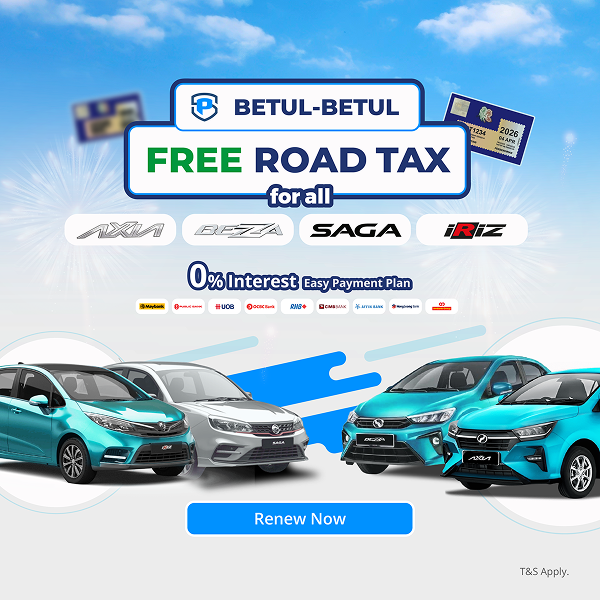

FREE Road Tax for Axia, Bezza, Saga, & Iriz Owners!

Drive Worry-Free! Renew with PolicyStreet and Get FREE Road Tax for Axia, Bezza, Saga, & Iriz.

Atome is Now on PolicyStreet

Pay with Atome and split your payments up to 6 months with 0% interest.

Save More on Car Insurance

Enjoy FREE digital road tax + RM 10 discount on your car insurance.

Restructure Your Employee Benefits & Manage The Costs

We customise your employee welfare based your business needs and budgets.